Planning for retirement can feel like trying to solve a puzzle with missing pieces. Markets change, inflation creeps in quietly, and life throws curveballs. But what if there were a simple shortcut—a mental math trick—that could instantly help you understand how fast your money might grow? That’s where rule of 72 retirement planning comes into play.

This classic financial rule has been used for decades by investors, advisors, and retirement planners because it’s easy, practical, and surprisingly powerful. Let’s break it down in plain English and show you how Plush Retirement uses it to help Texans plan smarter retirements.

Introduction to the Rule of 72

Why Simple Math Matters in Retirement

Retirement planning doesn’t need to be complicated to be effective. In fact, the best strategies are often the simplest ones. The Rule of 72 gives you a quick way to estimate how long it takes for your investment to double—without a calculator, spreadsheet, or finance degree.

Think of it like a speedometer for your money. You instantly know whether you’re cruising comfortably toward retirement or crawling along the shoulder.

What Is the Rule of 72?

The Basic Formula Explained

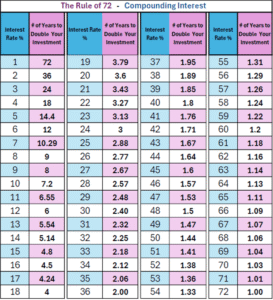

The Rule of 72 states:

72 ÷ annual rate of return = number of years it takes for your money to double

For example:

-

If your investment earns 6% annually

-

72 ÷ 6 = 12 years to double your money

That’s it. No complicated formulas. No fine print.

Why the Number 72 Works

Why 72 and not 70 or 75? Because 72 is divisible by many common interest rates (2, 3, 4, 6, 8, 9, 12), making it incredibly flexible and accurate for typical long-term investment returns—especially those used in retirement planning.

How the Rule of 72 Applies to Retirement Planning

Understanding Investment Growth

When planning for retirement, growth matters more than timing the market. The Rule of 72 helps you visualize how your savings compound over decades. If your money doubles every 10–12 years, that can mean the difference between just getting by and retiring comfortably.

It’s like planting a tree. You don’t see much growth early on, but give it time—and suddenly it’s providing shade for decades.

Using the Rule of 72 to Estimate Retirement Savings Growth

Practical Examples

Let’s say you have $100,000 saved for retirement:

-

At 6%, it doubles to $200,000 in 12 years

-

In another 12 years, it becomes $400,000

-

That’s the power of compounding at work

Conservative vs Aggressive Returns

-

4% return → doubles in 18 years

-

8% return → doubles in 9 years

This comparison alone can reshape how you think about risk, asset allocation, and long-term strategy.

Rule of 72 and Inflation

How Inflation Eats Your Retirement

The Rule of 72 isn’t just about growth—it also applies to inflation. If inflation averages 3%, your purchasing power halves roughly every 24 years (72 ÷ 3).

That means $100,000 today may feel like $50,000 in the future. Ignoring inflation is like filling a leaky bucket and hoping it stays full.

Why the Rule of 72 Is Popular Among Financial Planners

Financial advisors love the Rule of 72 because it:

-

Simplifies complex concepts

-

Helps clients set realistic expectations

-

Encourages long-term thinking

At Plush Retirement, it’s often the first concept introduced when helping clients understand retirement timelines.

Limitations of the Rule of 72

When the Formula Falls Short

The Rule of 72 is an estimate—not a crystal ball. It works best with:

-

Steady returns

-

Long-term investing

It doesn’t account for:

-

Market volatility

-

Taxes

-

Fees

-

Contribution changes

That’s why it should be a starting point, not the entire plan.

Rule of 72 vs Compound Interest Calculators

Calculators provide precision. The Rule of 72 provides clarity.

Think of the Rule of 72 as a roadmap and calculators as GPS. Both matter—but you need the big picture first.

Real-Life Retirement Scenarios Using the Rule of 72

Imagine two savers:

-

Saver A starts at 25

-

Saver B starts at 40

Even if Saver B invests more, Saver A often ends up ahead—because their money doubles more times. Time, not effort, is the secret ingredient.

How Often Should Your Money Double Before Retirement?

Ideally:

-

Once in early career

-

Again in mid-career

-

One final time before retirement

Each doubling dramatically reduces the stress on future contributions.

Rule of 72 and Tax-Advantaged Retirement Accounts

401(k), IRA, and Roth IRA

Tax-advantaged accounts amplify the Rule of 72:

-

Fewer taxes = faster doubling

-

Roth accounts can double tax-free

This is where strategic planning makes all the difference.

Common Mistakes When Using the Rule of 72

-

Assuming returns are guaranteed

-

Ignoring inflation

-

Forgetting fees

-

Not adjusting for risk tolerance

Avoid these, and the Rule of 72 becomes a powerful ally.

How Plush Retirement Uses the Rule of 72 for Clients

Plush Retirement uses the Rule of 72 as an educational tool to:

-

Set expectations

-

Compare strategies

-

Illustrate long-term outcomes

📞 Call (214) 796-5626

🌐 https://plushretirement.com/retirement-rule-of-72/

Why Professional Guidance Matters in Retirement Planning

Online formulas are helpful—but personalized advice is priceless. A professional advisor aligns math with your goals, lifestyle, and risk tolerance.

Getting Started with Rule of 72 Retirement Planning

Start by asking:

-

What rate of return am I earning?

-

How long until retirement?

-

How many times can my money double?

Then build a plan around those answers.

Conclusion

The Rule of 72 retirement strategy is simple, elegant, and incredibly insightful. While it won’t replace a full financial plan, it gives you instant clarity about where you stand and where you’re headed. When paired with expert guidance from Plush Retirement, it becomes a powerful foundation for long-term financial confidence.

FAQs

1. Is the Rule of 72 accurate for retirement planning?

Yes, it’s a reliable estimate for long-term, steady returns.

2. Can the Rule of 72 be used for inflation?

Absolutely. It helps estimate how fast purchasing power declines.

3. What rate of return works best with the Rule of 72?

It’s most accurate between 4% and 10%.

4. Should I rely only on the Rule of 72?

No. It should complement a full retirement strategy.

5. Can Plush Retirement help apply the Rule of 72 to my plan?

Yes. Plush Retirement uses it as part of a personalized retirement roadmap.